Pravasi Bharatiya Bima Yojana (PBBY) is a mandatory insurance scheme launched by the Ministry of External Affairs (MEA) of India, specifically designed to protect the interests of Indian emigrant workers falling under the Emigration Check Required (ECR) category. This scheme provides comprehensive coverage to workers employed in ECR countries, offering financial security against various risks, including accidental death, permanent disability, and medical emergencies. With affordable premiums and extensive benefits—such as hospitalization expenses, maternity coverage, and legal assistance—PBBY ensures that migrant workers receive essential support during their overseas employment.

Table of Contents

Pravasi Bharatiya Bima Yojana Overview

Pravasi Bharatiya Bima Yojana (PBBY) is a comprehensive insurance scheme initiated by the Ministry of External Affairs (MEA) of India, aimed specifically at safeguarding the interests of Indian emigrant workers classified under the Emigration Check Required (ECR) category. Launched to provide essential financial protection, PBBY covers a range of risks that these workers may face while employed in ECR countries. The scheme offers significant benefits, including compensation for accidental death and permanent disability, coverage for hospitalization expenses, maternity benefits for female workers, and legal assistance for employment-related disputes.

With affordable premiums—starting as low as ₹275 for a two-year policy—PBBY is designed to be accessible to a broad spectrum of workers. The claims process is streamlined by accepting documentation from Indian missions abroad, which accelerates the settlement of claims. Additionally, the provision for online policy renewals enhances convenience for migrants. Overall, PBBY reflects India’s commitment to the welfare of its emigrant workers, providing them with the necessary support and security to navigate the challenges of working overseas.

Pravasi Bharatiya Bima Yojana Benefits

Pravasi Bharatiya Bima Yojana (PBBY) offers a wide array of benefits designed to ensure the financial security and well-being of Indian emigrant workers. Here are the key advantages of this comprehensive insurance scheme –

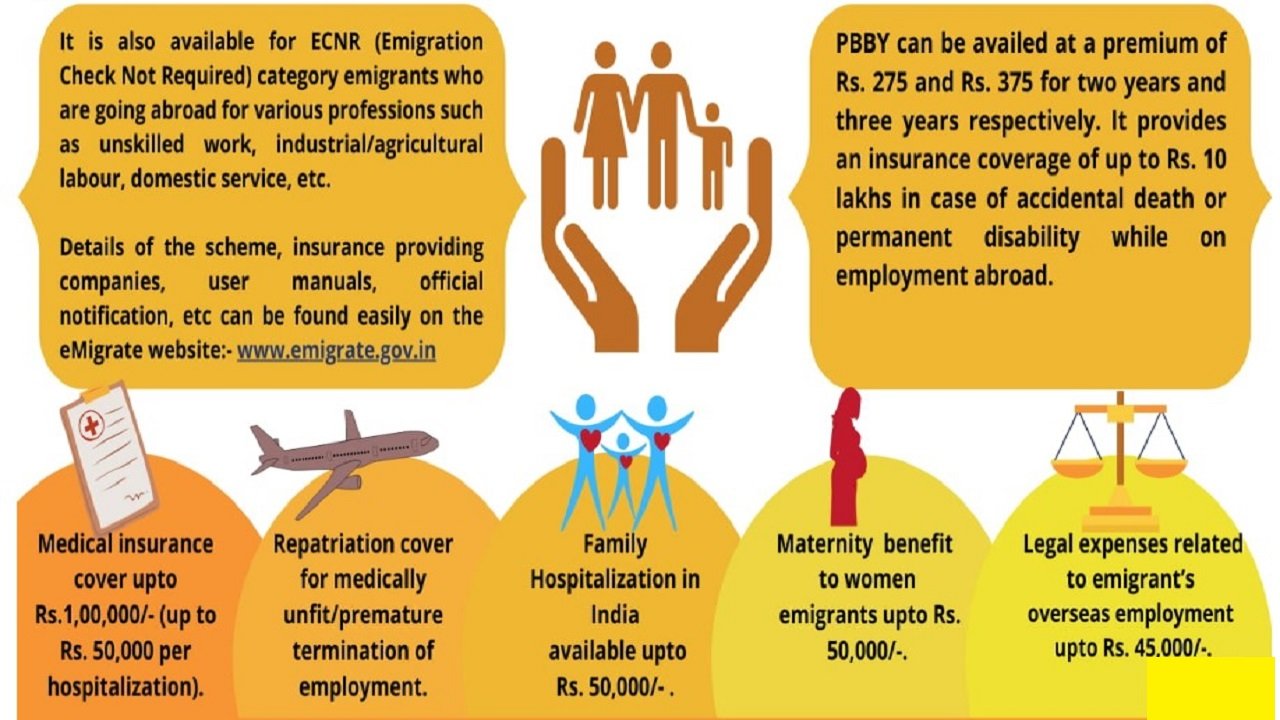

- Protection Against Accidental Death and Disability: PBBY provides substantial coverage of up to ₹10 lakh in the event of accidental death or permanent disability of the insured migrant worker. This ensures that the worker’s family is financially supported during a critical time.

- Comprehensive Medical Coverage: The scheme covers hospitalization expenses up to ₹1 lakh for medical emergencies, including accidents and illnesses. This financial protection is crucial for workers who may not have access to adequate healthcare facilities abroad.

- Maternity Benefits: Female emigrant workers are entitled to maternity coverage of up to ₹50,000, which addresses the unique healthcare needs of women and supports them during pregnancy and childbirth.

- Family Medical Coverage in India: PBBY also extends coverage for medical expenses incurred by the insured worker’s spouse and children in India, offering up to ₹50,000 for their hospitalization. This ensures that the family back home is also taken care of during medical emergencies.

- Legal Assistance: The scheme includes coverage for legal expenses up to ₹45,000 related to employment disputes in the host country. This feature is particularly valuable for workers who may face legal challenges or need representation.

- Affordable Premiums: The insurance policy is economically designed, with premiums starting at just ₹275 for a two-year plan and ₹375 for a three-year plan. This makes it accessible for a wide range of migrant workers.

- Simplified Claims Process: PBBY streamlines the claims process by allowing acceptance of certification issued by Indian missions abroad for accidental death or permanent disability. This reduces bureaucratic hurdles and expedites claim settlements.

- Online Policy Renewal: Migrant workers can easily renew their insurance policies online, enhancing convenience and ensuring that they remain covered throughout their employment abroad.

- Support for Return Travel: The scheme covers the cost of a one-way economy class airfare for the insured worker in cases of medical repatriation or premature termination of employment, which alleviates the financial burden of returning home.

- Comprehensive Coverage for Employment-Related Issues: PBBY protects against the risk of job loss due to unforeseen circumstances, ensuring that migrant workers have a safety net in case their employment is abruptly terminated.

- Overall, the Pravasi Bharatiya Bima Yojana plays a vital role in ensuring the safety and welfare of Indian emigrant workers, equipping them with the necessary resources to face challenges while working abroad. By providing extensive coverage and support, PBBY enhances the overall experience of Indian migrants and helps them focus on their work and personal growth.

Eligibility Criteria for Pravasi Bharatiya Bima Yojana (PBBY)

The Pravasi Bharatiya Bima Yojana (PBBY) is designed specifically for Indian emigrant workers, and it has set forth certain eligibility criteria to ensure that the scheme effectively meets the needs of its intended beneficiaries. Here are the detailed eligibility requirements –

- Indian Citizenship: To be eligible for PBBY, applicants must be Indian citizens. This ensures that the scheme is dedicated to providing support exclusively to Indian emigrant workers.

- Emigration Check Required (ECR) Category: The scheme is specifically aimed at individuals who fall under the ECR category. This includes workers who require emigration clearance under the Emigration Act of 1983, which typically applies to unskilled or semi-skilled laborers seeking employment in designated countries.

- Age Limit: Applicants must be between the ages of 18 and 65 years. This age range is intended to include individuals who are generally in the working population, ensuring that younger and older individuals can benefit from the scheme.

- Employment in Specified Categories: Eligible applicants should belong to various professions listed under Section 2(0) of the Emigration Act, 1983. These typically include sectors where emigration is regulated, ensuring that the scheme is relevant to those working in specific industries abroad.

- Valid Documentation: Applicants must possess valid travel documents, such as a passport and visa, that comply with the regulations of the host country. These documents should be current and should not have expired during the duration of the insurance policy.

- Compliance with Government Regulations: Eligible workers must adhere to the guidelines and regulations set by the Indian government concerning emigration. This includes obtaining the necessary clearances before taking up employment in foreign countries.

- No Pending Claims or Fraudulent Activity: Individuals who have previously made claims under the scheme that were rejected due to discrepancies or fraudulent activities are typically ineligible for future coverage. The Pravasi Bharatiya Bima Yojana aims to maintain its integrity and support genuine claimants.

Pravasi Bharatiya Bima Yojana Apply Online

The online application process for the Pravasi Bharatiya Bima Yojana (PBBY) has been designed to be user-friendly and efficient, making it easier for Indian emigrant workers to secure essential insurance coverage before embarking on their overseas employment. To apply online, applicants must first visit the official website designated for the PBBY scheme. Upon accessing the site, users will find a dedicated section for the PBBY application. Here, they will be required to fill out an online application form, providing necessary details such as personal information, employment details, and passport information.

Additionally, applicants must upload supporting documents, including a valid passport, visa, and any other relevant identification as specified in the guidelines. Pravasi Bharatiya Bima Yojana Once the form is completed and documents are uploaded, applicants can submit their application. After submission, they will receive an acknowledgment with a unique application reference number for tracking their status. The online platform also facilitates easy payment of the insurance premium through various secure payment methods.

This streamlined process not only saves time but also allows workers to conveniently access their insurance coverage, ensuring they are well-prepared for their employment abroad. Overall, the online application system enhances accessibility and ensures that Indian emigrants can quickly obtain the protection they need while working in foreign countries.

Overseas Indian Insurance Scheme Application Form

The application form for the Overseas Indian Insurance Scheme is a crucial document designed to facilitate the enrollment of Indian emigrant workers seeking insurance coverage while working abroad. This form can typically be accessed online through the official website of the Ministry of External Affairs (MEA) or designated insurance providers. The form is structured to gather essential information about the applicant, including personal details such as name, age, nationality, and contact information, as well as specifics related to their employment, such as the name of the employer, job title, and the country of employment.

Applicants are also required to provide documentation to support their application, including a valid passport, visa, and any other identification that may be necessary to verify their eligibility under the scheme. The form may include sections for declaring health information, previous insurance coverage, and any pre-existing medical conditions, which are vital for assessing risk and determining coverage terms. Once completed, the application form must be submitted along with the required documents, and applicants can usually pay the insurance premium online.

Upon submission, applicants will receive an acknowledgment confirming their application, which includes a unique reference number for tracking purposes. This streamlined process ensures that Indian emigrants can efficiently secure the insurance coverage they need, providing them with peace of mind as they embark on their overseas employment.

Overseas Indian Insurance Scheme Claim

Filing a claim under the Overseas Indian Insurance Scheme is a structured process designed to ensure that Indian emigrant workers can access their entitled benefits efficiently and effectively. To initiate a claim, the insured individual or their beneficiaries should first gather all necessary documentation, including the original policy document, proof of the incident (such as medical reports or death certificates), and any relevant paperwork related to the claim, like hospital bills or legal documents.

The next step involves contacting the insurance provider or the relevant Indian mission abroad to obtain the specific claim form. This form typically requires detailed information about the incident, the insured individual, and the nature of the claim being filed—whether it pertains to accidental death, disability, or medical expenses.

Once the claim form is completed, it should be submitted along with the supporting documents to the insurance company or the designated authority. Many insurance providers offer the option to file claims online, making it easier for applicants to submit their information and track the status of their claims. After submission, the insurance company will review the claim and may reach out for additional information or clarification if needed.

Claimants should be aware of the timelines specified in the policy for filing claims, as delays may affect the approval process. Once the claim is processed, the insurance company will communicate the outcome, and if approved, the compensation will be disbursed according to the terms of the policy. Overall, understanding the claims process and adhering to the required steps ensures that emigrant workers can efficiently access the benefits they are entitled to under the Overseas Indian Insurance Scheme.